Forex trading online platforms have revolutionized the way individuals conduct currency trading. With a plethora of options available, it is essential to choose a platform that suits your trading style and needs. This article explores the various aspects of forex trading platforms, highlighting their features, benefits, and how to make an informed choice. If you are considering trading with forex trading online platform Morocco Brokers, or seeking alternative options, this guide will provide you with the necessary insights.

Understanding Forex Trading Platforms

Forex trading platforms are software applications that allow traders to buy and sell currency pairs over the Foreign Exchange Market. These platforms connect traders to the market via a brokerage firm, offering the tools and resources necessary for trading. They can be web-based or downloaded as desktop applications, and mobile versions are also widely available.

Key Features of Forex Trading Platforms

When selecting a forex trading online platform, several key features are usually considered:

- User Interface: A user-friendly interface is crucial for both beginners and experienced traders to navigate the platform effectively.

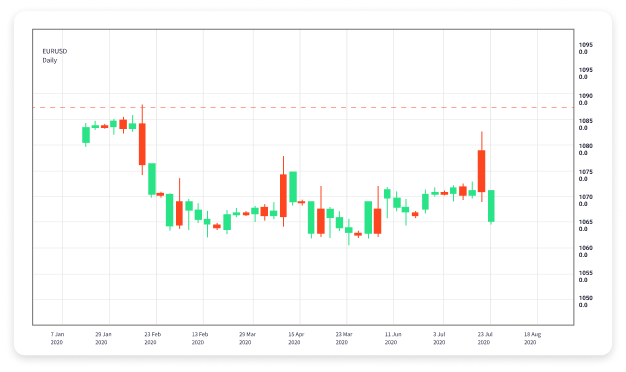

- Charting Tools: Advanced charting tools, technical indicators, and analysis options can enhance trading strategies significantly.

- Execution Speed: Fast order execution times are vital, especially for day traders who rely on real-time market movements.

- Risk Management Tools: Features like stop-loss orders, limit orders, and trailing stops help traders manage risks effectively.

- Mobile Access: The ability to trade on-the-go via mobile applications is increasingly important for modern traders.

- Educational Resources: Platforms that provide tutorials, articles, and webinars can greatly benefit new traders seeking to improve their knowledge and skills.

Types of Forex Trading Platforms

Forex trading platforms can generally be classified into three main categories:

- MetaTrader 4 (MT4): One of the most popular trading platforms globally, MT4 offers a wide range of tools and features, making it suitable for both beginners and experienced traders.

- MetaTrader 5 (MT5): An upgraded version of MT4, MT5 includes additional features like more timeframes, built-in economic calendar, and enhanced trading functionalities.

- Proprietary Platforms: Some brokers offer proprietary trading platforms specifically designed to meet the needs of their clients, often featuring unique tools that set them apart from the standard offerings.

Benefits of Trading on Online Platforms

Utilizing an online forex trading platform offers a multitude of benefits, including:

- Accessibility: Traders can access the forex market from anywhere in the world at any time, which is essential for effective trading.

- Cost Efficiency: Many online platforms offer lower commissions and spreads compared to traditional brokers, making trading more affordable.

- Leverage Opportunities: Forex platforms often provide leverage options, allowing traders to control a larger position than their initial investment would typically allow.

- Diverse Instruments: These platforms offer access to a wide range of trading instruments, including currency pairs, commodities, and indices.

- Real-time Data: Access to live market data, news feeds, and automated trading systems can enhance trading decisions.

Choosing the Right Forex Trading Online Platform

With numerous forex trading platforms available, choosing the right one can be overwhelming. Here are some tips to help navigate this choice:

- Research and Compare: Take the time to research different platforms. Consider factors such as fees, minimum deposit, available currency pairs, and customer service.

- Read Reviews: User testimonials and expert reviews can provide insight into the platform’s reliability and performance.

- Demo Accounts: Many platforms offer demo accounts that allow traders to practice trading with virtual money. This is a great way to test the platform before committing real funds.

- Regulatory Compliance: Ensure the platform is regulated by a reputable authority. This adds a layer of safety and credibility.

Conclusion

Forex trading online platforms are essential tools for anyone looking to engage in currency trading. By understanding the features, benefits, and types of platforms available, traders can make informed decisions that align with their trading goals. Whether you choose to trade through established options or explore innovative platforms, the key to success lies in education, practice, and strategic planning. As you embark on your forex trading journey, remember that proper research and responsible trading practices are paramount.

Recent Comments